Interposer Market Poised for Exceptional Growth Through 2032

Interposer Market was valued at a robust USD 292 million in 2024 and is positioned on an exceptional growth trajectory, projected to surge from USD 356 million in 2025 to USD 1130 million by 2032. This significant expansion, representing a compound annual growth rate (CAGR) of 21.9%, is detailed in a comprehensive new report published by Semiconductor Insight. The study underscores the critical function of interposers as an essential enabling technology for advanced semiconductor packaging, which is fundamental to meeting the performance demands of next-generation electronics across industries.

Interposers, essentially the sophisticated "bridges" within electronic packages, enable high-density interconnects between multiple semiconductor dies. They are becoming indispensable for heterogeneous integration, allowing different components like processors, memory, and sensors to be packed closely together, thereby boosting performance and energy efficiency while reducing the overall footprint. This technology is a cornerstone for the continued advancement of computing power in line with Moore's Law, particularly as transistor shrinkage becomes increasingly complex and costly.

High-Performance Computing and AI: The Catalysts for Market Acceleration

The report identifies the insatiable demand for High-Performance Computing (HPC) and Artificial Intelligence (AI) as the paramount drivers for interposer adoption. The need for immense data processing speeds and bandwidth in AI training, data centers, and advanced networking is pushing semiconductor design beyond traditional monolithic chips. Heterogeneous integration, facilitated by interposers, allows for the combination of specialized chiplets—such as CPUs, GPUs, and high-bandwidth memory (HBM)—into a single, powerful package. This architectural shift is crucial for overcoming the limitations of data transfer speeds and power consumption that plague conventional designs.

"The transition towards chiplet-based architectures and 2.5D packaging is not just a trend; it's a fundamental redesign of how we build high-performance systems," the report states. "Leading foundries and major technology firms are investing billions in advanced packaging capabilities, with interposers at the very heart of this transformation. As AI workloads evolve to require even faster memory access and lower latency, the role of the silicon interposer in connecting processors to HBM stacks becomes absolutely critical." This demand is further amplified by the expansion of cloud computing infrastructure and the proliferation of edge computing devices, all of which rely on the performance benefits unlocked by interposer technology.

Read the Full Report: https://semiconductorinsight.com/report/interposer-market/

Market Segmentation: 2.5D Interposers and AI/ML Applications Lead

The report provides a detailed segmentation analysis, offering a granular view of the market structure and the segments poised for the strongest growth:

Segment Analysis:

By Type

• 2D Interposer

• 2.5D Interposer

• 3D Interposer

By Application

• ASIC/FPGA

• CPU/GPU/Microprocessors

• MEMS and Sensor Applications

• High-Bandwidth Memory (HBM)

• CMOS Image Sensors (CIS)

• RF Devices

• LED

By Material

• Silicon Interposer

• Glass Interposer

• Organic Interposer

By End User

• Consumer Electronics

• Automotive

• Telecommunications & Data Centers

• Healthcare & Life Sciences

• Industrial

• Aerospace & Defense

Download a FREE Sample Report: https://semiconductorinsight.com/download-sample-report/?product_id=127141

Competitive Landscape: A Concentrated Field of Technology Leaders

The global interposer market is characterized by a high level of consolidation among a few key players who possess significant expertise in semiconductor fabrication and advanced packaging. The competitive dynamics are heavily influenced by intense R&D investment, deep-rooted partnerships with major fabless chip companies, and control over sophisticated manufacturing processes. The capital-intensive nature of establishing and maintaining production lines for technologies like Through-Silicon Vias (TSVs) creates substantial barriers to entry, solidifying the positions of established leaders.

The report profiles key industry players who are shaping the market's trajectory, including:

• Taiwan Semiconductor Manufacturing Company (TSMC)

• Murata Manufacturing Co., Ltd.

• Xilinx, Inc. (Acquired by Advanced Micro Devices, Inc.)

• AGC Electronics Co.

• Tezzaron Semiconductor

• United Microelectronics Corporation (UMC)

• Plan Optik AG

• Amkor Technology, Inc.

• IMT (Innovative Micro Technology)

• ALLVIA, Inc.

• STATS ChipPAC Pte. Ltd. (a subsidiary of JCET)

• PTI Advanced Technology Inc.

• IQE plc

These companies are focusing on developing next-generation interposer solutions with finer pitch TSVs, improved thermal management, and the integration of novel materials like glass and advanced organics. Strategic collaborations and capacity expansion in advanced packaging facilities are central to their growth strategies as they vie for leadership in the high-growth AI and HPC segments.

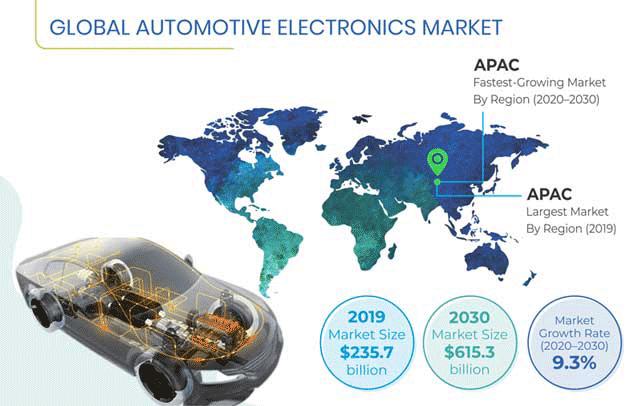

Emerging Opportunities in Automotive and Silicon Photonics

Beyond the dominant forces of AI and HPC, the report identifies promising growth avenues in other high-tech sectors. The automotive industry, particularly with the rise of autonomous driving and electric vehicles (EVs), presents a significant opportunity. Modern vehicles are becoming data centers on wheels, requiring powerful, reliable computing for ADAS, infotainment, and powertrain control. Interposers enable the creation of the robust, high-performance system-in-package (SiP) solutions needed for these demanding automotive applications.

Another frontier is silicon photonics, where interposers are used to integrate optical components with electronic circuits. This is becoming increasingly important for data centers and high-speed communication networks to overcome bandwidth bottlenecks and reduce power consumption associated with data transfer. The convergence of electronics and photonics on a single interposer platform is a key technological trend, opening up new markets for high-speed transceivers and optical computing.

Navigating Market Challenges and Technological Hurdles

Despite the promising outlook, the interposer market faces its own set of challenges. The manufacturing process, especially for silicon interposers with high-density TSVs, is complex and expensive. Yield management and testing at the interposer level add significant cost, which can be a barrier for broader adoption beyond high-margin applications. Furthermore, thermal management becomes increasingly critical as more power-dense components are packed closely together, requiring sophisticated co-design of the interposer, package, and cooling solutions.

Supply chain dynamics also present a challenge. The market's reliance on advanced semiconductor fabrication tools and specialized materials means that any disruption can have a ripple effect. Companies are actively working on developing more cost-effective manufacturing processes and exploring alternative materials like glass, which offers advantages in electrical performance and potentially lower cost for specific applications, to mitigate these challenges and expand the technology's reach.

Report Scope and Availability

The market research report offers a comprehensive analysis of the global and regional Interposer markets from 2025–2032. It provides detailed segmentation, market size forecasts, competitive intelligence, technology trends, and an in-depth evaluation of the key market dynamics, including drivers, restraints, and opportunities.

For a detailed analysis of market drivers, restraints, opportunities, and the competitive strategies of key players, access the complete report.

Download FREE Sample Report: Interposer Market - View in Detailed Research Report

Get Full Report Here: Interposer Market, Global Business Strategies 2025-2032 - View in Detailed Research Report

About Semiconductor Insight

Semiconductor Insight is a leading provider of market intelligence and strategic consulting for the global semiconductor and high-technology industries. Our in-depth reports and analysis offer actionable insights to help businesses navigate complex market dynamics, identify growth opportunities, and make informed decisions. We are committed to delivering high-quality, data-driven research to our clients worldwide.

Website: https://semiconductorinsight.com/

International: +91 8087 99 2013

LinkedIn: Follow Us

#InterposerMarket,

#InterposerGrowth,

#InterposerIndustry,

#InterposerTrends,

#InterposerForecast

Interposer Market was valued at a robust USD 292 million in 2024 and is positioned on an exceptional growth trajectory, projected to surge from USD 356 million in 2025 to USD 1130 million by 2032. This significant expansion, representing a compound annual growth rate (CAGR) of 21.9%, is detailed in a comprehensive new report published by Semiconductor Insight. The study underscores the critical function of interposers as an essential enabling technology for advanced semiconductor packaging, which is fundamental to meeting the performance demands of next-generation electronics across industries.

Interposers, essentially the sophisticated "bridges" within electronic packages, enable high-density interconnects between multiple semiconductor dies. They are becoming indispensable for heterogeneous integration, allowing different components like processors, memory, and sensors to be packed closely together, thereby boosting performance and energy efficiency while reducing the overall footprint. This technology is a cornerstone for the continued advancement of computing power in line with Moore's Law, particularly as transistor shrinkage becomes increasingly complex and costly.

High-Performance Computing and AI: The Catalysts for Market Acceleration

The report identifies the insatiable demand for High-Performance Computing (HPC) and Artificial Intelligence (AI) as the paramount drivers for interposer adoption. The need for immense data processing speeds and bandwidth in AI training, data centers, and advanced networking is pushing semiconductor design beyond traditional monolithic chips. Heterogeneous integration, facilitated by interposers, allows for the combination of specialized chiplets—such as CPUs, GPUs, and high-bandwidth memory (HBM)—into a single, powerful package. This architectural shift is crucial for overcoming the limitations of data transfer speeds and power consumption that plague conventional designs.

"The transition towards chiplet-based architectures and 2.5D packaging is not just a trend; it's a fundamental redesign of how we build high-performance systems," the report states. "Leading foundries and major technology firms are investing billions in advanced packaging capabilities, with interposers at the very heart of this transformation. As AI workloads evolve to require even faster memory access and lower latency, the role of the silicon interposer in connecting processors to HBM stacks becomes absolutely critical." This demand is further amplified by the expansion of cloud computing infrastructure and the proliferation of edge computing devices, all of which rely on the performance benefits unlocked by interposer technology.

Read the Full Report: https://semiconductorinsight.com/report/interposer-market/

Market Segmentation: 2.5D Interposers and AI/ML Applications Lead

The report provides a detailed segmentation analysis, offering a granular view of the market structure and the segments poised for the strongest growth:

Segment Analysis:

By Type

• 2D Interposer

• 2.5D Interposer

• 3D Interposer

By Application

• ASIC/FPGA

• CPU/GPU/Microprocessors

• MEMS and Sensor Applications

• High-Bandwidth Memory (HBM)

• CMOS Image Sensors (CIS)

• RF Devices

• LED

By Material

• Silicon Interposer

• Glass Interposer

• Organic Interposer

By End User

• Consumer Electronics

• Automotive

• Telecommunications & Data Centers

• Healthcare & Life Sciences

• Industrial

• Aerospace & Defense

Download a FREE Sample Report: https://semiconductorinsight.com/download-sample-report/?product_id=127141

Competitive Landscape: A Concentrated Field of Technology Leaders

The global interposer market is characterized by a high level of consolidation among a few key players who possess significant expertise in semiconductor fabrication and advanced packaging. The competitive dynamics are heavily influenced by intense R&D investment, deep-rooted partnerships with major fabless chip companies, and control over sophisticated manufacturing processes. The capital-intensive nature of establishing and maintaining production lines for technologies like Through-Silicon Vias (TSVs) creates substantial barriers to entry, solidifying the positions of established leaders.

The report profiles key industry players who are shaping the market's trajectory, including:

• Taiwan Semiconductor Manufacturing Company (TSMC)

• Murata Manufacturing Co., Ltd.

• Xilinx, Inc. (Acquired by Advanced Micro Devices, Inc.)

• AGC Electronics Co.

• Tezzaron Semiconductor

• United Microelectronics Corporation (UMC)

• Plan Optik AG

• Amkor Technology, Inc.

• IMT (Innovative Micro Technology)

• ALLVIA, Inc.

• STATS ChipPAC Pte. Ltd. (a subsidiary of JCET)

• PTI Advanced Technology Inc.

• IQE plc

These companies are focusing on developing next-generation interposer solutions with finer pitch TSVs, improved thermal management, and the integration of novel materials like glass and advanced organics. Strategic collaborations and capacity expansion in advanced packaging facilities are central to their growth strategies as they vie for leadership in the high-growth AI and HPC segments.

Emerging Opportunities in Automotive and Silicon Photonics

Beyond the dominant forces of AI and HPC, the report identifies promising growth avenues in other high-tech sectors. The automotive industry, particularly with the rise of autonomous driving and electric vehicles (EVs), presents a significant opportunity. Modern vehicles are becoming data centers on wheels, requiring powerful, reliable computing for ADAS, infotainment, and powertrain control. Interposers enable the creation of the robust, high-performance system-in-package (SiP) solutions needed for these demanding automotive applications.

Another frontier is silicon photonics, where interposers are used to integrate optical components with electronic circuits. This is becoming increasingly important for data centers and high-speed communication networks to overcome bandwidth bottlenecks and reduce power consumption associated with data transfer. The convergence of electronics and photonics on a single interposer platform is a key technological trend, opening up new markets for high-speed transceivers and optical computing.

Navigating Market Challenges and Technological Hurdles

Despite the promising outlook, the interposer market faces its own set of challenges. The manufacturing process, especially for silicon interposers with high-density TSVs, is complex and expensive. Yield management and testing at the interposer level add significant cost, which can be a barrier for broader adoption beyond high-margin applications. Furthermore, thermal management becomes increasingly critical as more power-dense components are packed closely together, requiring sophisticated co-design of the interposer, package, and cooling solutions.

Supply chain dynamics also present a challenge. The market's reliance on advanced semiconductor fabrication tools and specialized materials means that any disruption can have a ripple effect. Companies are actively working on developing more cost-effective manufacturing processes and exploring alternative materials like glass, which offers advantages in electrical performance and potentially lower cost for specific applications, to mitigate these challenges and expand the technology's reach.

Report Scope and Availability

The market research report offers a comprehensive analysis of the global and regional Interposer markets from 2025–2032. It provides detailed segmentation, market size forecasts, competitive intelligence, technology trends, and an in-depth evaluation of the key market dynamics, including drivers, restraints, and opportunities.

For a detailed analysis of market drivers, restraints, opportunities, and the competitive strategies of key players, access the complete report.

Download FREE Sample Report: Interposer Market - View in Detailed Research Report

Get Full Report Here: Interposer Market, Global Business Strategies 2025-2032 - View in Detailed Research Report

About Semiconductor Insight

Semiconductor Insight is a leading provider of market intelligence and strategic consulting for the global semiconductor and high-technology industries. Our in-depth reports and analysis offer actionable insights to help businesses navigate complex market dynamics, identify growth opportunities, and make informed decisions. We are committed to delivering high-quality, data-driven research to our clients worldwide.

Website: https://semiconductorinsight.com/

International: +91 8087 99 2013

LinkedIn: Follow Us

#InterposerMarket,

#InterposerGrowth,

#InterposerIndustry,

#InterposerTrends,

#InterposerForecast

Interposer Market Poised for Exceptional Growth Through 2032

Interposer Market was valued at a robust USD 292 million in 2024 and is positioned on an exceptional growth trajectory, projected to surge from USD 356 million in 2025 to USD 1130 million by 2032. This significant expansion, representing a compound annual growth rate (CAGR) of 21.9%, is detailed in a comprehensive new report published by Semiconductor Insight. The study underscores the critical function of interposers as an essential enabling technology for advanced semiconductor packaging, which is fundamental to meeting the performance demands of next-generation electronics across industries.

Interposers, essentially the sophisticated "bridges" within electronic packages, enable high-density interconnects between multiple semiconductor dies. They are becoming indispensable for heterogeneous integration, allowing different components like processors, memory, and sensors to be packed closely together, thereby boosting performance and energy efficiency while reducing the overall footprint. This technology is a cornerstone for the continued advancement of computing power in line with Moore's Law, particularly as transistor shrinkage becomes increasingly complex and costly.

High-Performance Computing and AI: The Catalysts for Market Acceleration

The report identifies the insatiable demand for High-Performance Computing (HPC) and Artificial Intelligence (AI) as the paramount drivers for interposer adoption. The need for immense data processing speeds and bandwidth in AI training, data centers, and advanced networking is pushing semiconductor design beyond traditional monolithic chips. Heterogeneous integration, facilitated by interposers, allows for the combination of specialized chiplets—such as CPUs, GPUs, and high-bandwidth memory (HBM)—into a single, powerful package. This architectural shift is crucial for overcoming the limitations of data transfer speeds and power consumption that plague conventional designs.

"The transition towards chiplet-based architectures and 2.5D packaging is not just a trend; it's a fundamental redesign of how we build high-performance systems," the report states. "Leading foundries and major technology firms are investing billions in advanced packaging capabilities, with interposers at the very heart of this transformation. As AI workloads evolve to require even faster memory access and lower latency, the role of the silicon interposer in connecting processors to HBM stacks becomes absolutely critical." This demand is further amplified by the expansion of cloud computing infrastructure and the proliferation of edge computing devices, all of which rely on the performance benefits unlocked by interposer technology.

Read the Full Report: https://semiconductorinsight.com/report/interposer-market/

Market Segmentation: 2.5D Interposers and AI/ML Applications Lead

The report provides a detailed segmentation analysis, offering a granular view of the market structure and the segments poised for the strongest growth:

Segment Analysis:

By Type

• 2D Interposer

• 2.5D Interposer

• 3D Interposer

By Application

• ASIC/FPGA

• CPU/GPU/Microprocessors

• MEMS and Sensor Applications

• High-Bandwidth Memory (HBM)

• CMOS Image Sensors (CIS)

• RF Devices

• LED

By Material

• Silicon Interposer

• Glass Interposer

• Organic Interposer

By End User

• Consumer Electronics

• Automotive

• Telecommunications & Data Centers

• Healthcare & Life Sciences

• Industrial

• Aerospace & Defense

Download a FREE Sample Report: https://semiconductorinsight.com/download-sample-report/?product_id=127141

Competitive Landscape: A Concentrated Field of Technology Leaders

The global interposer market is characterized by a high level of consolidation among a few key players who possess significant expertise in semiconductor fabrication and advanced packaging. The competitive dynamics are heavily influenced by intense R&D investment, deep-rooted partnerships with major fabless chip companies, and control over sophisticated manufacturing processes. The capital-intensive nature of establishing and maintaining production lines for technologies like Through-Silicon Vias (TSVs) creates substantial barriers to entry, solidifying the positions of established leaders.

The report profiles key industry players who are shaping the market's trajectory, including:

• Taiwan Semiconductor Manufacturing Company (TSMC)

• Murata Manufacturing Co., Ltd.

• Xilinx, Inc. (Acquired by Advanced Micro Devices, Inc.)

• AGC Electronics Co.

• Tezzaron Semiconductor

• United Microelectronics Corporation (UMC)

• Plan Optik AG

• Amkor Technology, Inc.

• IMT (Innovative Micro Technology)

• ALLVIA, Inc.

• STATS ChipPAC Pte. Ltd. (a subsidiary of JCET)

• PTI Advanced Technology Inc.

• IQE plc

These companies are focusing on developing next-generation interposer solutions with finer pitch TSVs, improved thermal management, and the integration of novel materials like glass and advanced organics. Strategic collaborations and capacity expansion in advanced packaging facilities are central to their growth strategies as they vie for leadership in the high-growth AI and HPC segments.

Emerging Opportunities in Automotive and Silicon Photonics

Beyond the dominant forces of AI and HPC, the report identifies promising growth avenues in other high-tech sectors. The automotive industry, particularly with the rise of autonomous driving and electric vehicles (EVs), presents a significant opportunity. Modern vehicles are becoming data centers on wheels, requiring powerful, reliable computing for ADAS, infotainment, and powertrain control. Interposers enable the creation of the robust, high-performance system-in-package (SiP) solutions needed for these demanding automotive applications.

Another frontier is silicon photonics, where interposers are used to integrate optical components with electronic circuits. This is becoming increasingly important for data centers and high-speed communication networks to overcome bandwidth bottlenecks and reduce power consumption associated with data transfer. The convergence of electronics and photonics on a single interposer platform is a key technological trend, opening up new markets for high-speed transceivers and optical computing.

Navigating Market Challenges and Technological Hurdles

Despite the promising outlook, the interposer market faces its own set of challenges. The manufacturing process, especially for silicon interposers with high-density TSVs, is complex and expensive. Yield management and testing at the interposer level add significant cost, which can be a barrier for broader adoption beyond high-margin applications. Furthermore, thermal management becomes increasingly critical as more power-dense components are packed closely together, requiring sophisticated co-design of the interposer, package, and cooling solutions.

Supply chain dynamics also present a challenge. The market's reliance on advanced semiconductor fabrication tools and specialized materials means that any disruption can have a ripple effect. Companies are actively working on developing more cost-effective manufacturing processes and exploring alternative materials like glass, which offers advantages in electrical performance and potentially lower cost for specific applications, to mitigate these challenges and expand the technology's reach.

Report Scope and Availability

The market research report offers a comprehensive analysis of the global and regional Interposer markets from 2025–2032. It provides detailed segmentation, market size forecasts, competitive intelligence, technology trends, and an in-depth evaluation of the key market dynamics, including drivers, restraints, and opportunities.

For a detailed analysis of market drivers, restraints, opportunities, and the competitive strategies of key players, access the complete report.

Download FREE Sample Report: Interposer Market - View in Detailed Research Report

Get Full Report Here: Interposer Market, Global Business Strategies 2025-2032 - View in Detailed Research Report

About Semiconductor Insight

Semiconductor Insight is a leading provider of market intelligence and strategic consulting for the global semiconductor and high-technology industries. Our in-depth reports and analysis offer actionable insights to help businesses navigate complex market dynamics, identify growth opportunities, and make informed decisions. We are committed to delivering high-quality, data-driven research to our clients worldwide.

🌐 Website: https://semiconductorinsight.com/

📞 International: +91 8087 99 2013

🔗 LinkedIn: Follow Us

#InterposerMarket,

#InterposerGrowth,

#InterposerIndustry,

#InterposerTrends,

#InterposerForecast

·394 Views

·0 Reviews