Rising Demand for Secure Valuables Logistics

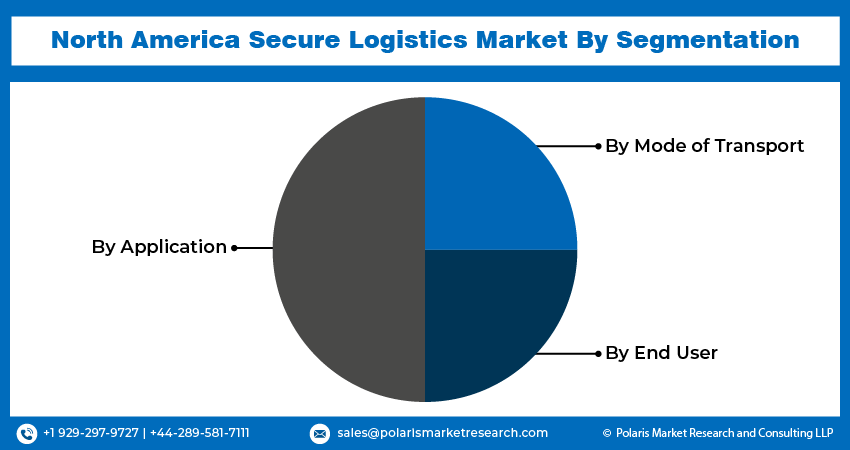

Polaris Market Research has published a brand-new report titled North America Secure Logistics Market Share, Size, Trends, Industry Analysis Report, By Application (Cash Management, Diamonds, Jewelry, & Precious Metals, Manufacturing, and Others); By Mode of Transport; By End User; By Country; Segment Forecast, 2024- 2032 that includes extensive information and analysis of the industry dynamics. The opportunities and challenges in the report's dynamical trends might be useful for the worldwide North America Secure Logistics Market. The study provides an outline of the market's foundation and organizational structure and forecasts an increase in market share. The study offers a comprehensive analysis of the North America Secure Logistics market size, present revenue, regular deliverables, share, and profit projections. The study report includes a sizable database on future market forecasting based on an examination of previous data.

Brief About the Report

The market's supply-side and demand-side North America Secure Logistics market trends are evaluated in the study. The study provides important details on applications and statistics, which are compiled in the report to provide a market prediction. Additionally, it offers thorough explanations of SWOT and PESTLE analyses depending on changes in the region and industry. It sheds light on risks, obstacles, and uncertainties, as well as present and future possibilities and challenges in the market.

North America secure logistics market size and share is currently valued at USD 15.04 billion in 2023 and is anticipated to generate an estimated revenue of USD 26.15 billion by 2032,according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 6.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032

Key Aspects Covered in The Report

Market size and growth rate during the forecast period.

Key vendors operating in the market with their company profiles

Opportunities and threats faced by the existing vendors in the market.

Trending factors influencing the market in the geographical regions.

In-depth understanding of market drivers, constraints, and major micro markets.

The critical data of each segment is highlighted at an extensive level.

North America Secure Logistics Market Segmentation Analysis

The study offers a thorough analysis of the numerous market segments, including application type, product component, service types, and several geographic locations. The report's segment analysis section contains thoroughly researched expert-verified industry data. Strategic recommendations are given in terms of key business segments based on market estimations.

Future Scope:

The future scope of the North America Secure Logistics Market is strengthened by rising demand for secure transportation, cash management, high-value goods handling, and risk-mitigation solutions across industries. As financial institutions modernize their operations, the need for advanced cash-in-transit services, ATM replenishment, and smart cash vault systems will grow. E-commerce expansion is also driving the secure movement of precious items, electronics, pharmaceuticals, luxury goods, and confidential documents. The integration of IoT, RFID tracking, GPS security systems, and real-time monitoring platforms is enabling greater transparency and operational efficiency. Advanced armored vehicles with enhanced surveillance systems are becoming essential for high-risk routes. The market will also see significant growth in secure logistics for digital assets, data servers, and sensitive IT equipment as cybersecurity and physical security converge. With the rise of legalized cannabis across several states, specialized logistics for cash-heavy businesses and temperature-controlled cannabis products is emerging as a new opportunity. Additionally, stricter compliance regulations in banking, defense, and government sectors will continue driving investment in secure supply chain systems. Automation, robotics, and AI-based route optimization will further streamline operations. Overall, the future market will be shaped by technological innovation, risk prevention, and expanding high-value logistics requirements.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/north-america-secure-logistics-market

Leading Players Analysis

The research report's chapter is entirely devoted to the competition environment. The North America Secure Logistics market key players are examined, analyzing information on their evaluation and development in addition to a quick review of the company. Understanding the techniques employed by businesses and the steps they have recently taken to combat intense rivalry allows one to examine the competitive landscape. It covers each player's company profiles comprising sales, revenue, share, recent developments, SWOT analysis, capacity, production, revenue, gross margin, growth rate, and strategies employed by the major market players.

Different potentials in the domestic and regional markets are revealed by regional analysis of the sector. Each regional industry associated with this market is carefully examined to determine its potential for growth in the present and the future. Moreover, information on recent mergers and acquisitions that have taken place in the market is the subject of the research. This section provides important financial information about mergers and acquisitions that have recently shaped the North America Secure Logistics industry.

Top Players:

Armored Knights (US)

Brinks Incorporated (US)

Dunbar Armored (US)

G4S Secure Solutions (US)

GardaWorld (Canada)

GardaWorld Federal Services (Canada)

LaserShip (US)

Loomis (US)

Securitas AB (US)

TransValue (US)

Wells Fargo Armored Service (US)

Regions Covered in This Report Are

North America (United States, Canada, and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and the rest of South America)

The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

Report Summary

The analysis focuses on the regional forecast by type and application and the North America Secure Logistics market sales and revenue prediction. The research report features data about the target market, such as pricing trends, customer requirements, and competitor analysis. The market growth has been examined using analytical approaches like PESTLE analysis, Porter's Five Forces analysis, feasibility studies, player-specific SWOT analyses, and ROI analyses.

Objectives of the Report

To carefully analyze and forecast the size of the market by value and volume.

To evaluate the market shares of major segments of the market

To explain the development of the industry in different parts of the world.

To analyze and study micro-markets in terms of their contributions to the market, their prospects, and individual growth trends.

To offer precise and valuable details about factors affecting the North America Secure Logistics market forecasts

To provide a meticulous assessment of crucial business strategies used by leading companies.

More Trending Latest Reports By Polaris Market Research:

Liquid Nitrogen Market

Biological Safety Testing Product and Services Market

Multiomics Market

Hospital Electronic Health Records Market

Biological Safety Testing Product and Services Market

DNA Diagnostics Market

Disaster Recovery As A Service Market

CBRN Defense Market

Japan Immunoassay Market

Polaris Market Research has published a brand-new report titled North America Secure Logistics Market Share, Size, Trends, Industry Analysis Report, By Application (Cash Management, Diamonds, Jewelry, & Precious Metals, Manufacturing, and Others); By Mode of Transport; By End User; By Country; Segment Forecast, 2024- 2032 that includes extensive information and analysis of the industry dynamics. The opportunities and challenges in the report's dynamical trends might be useful for the worldwide North America Secure Logistics Market. The study provides an outline of the market's foundation and organizational structure and forecasts an increase in market share. The study offers a comprehensive analysis of the North America Secure Logistics market size, present revenue, regular deliverables, share, and profit projections. The study report includes a sizable database on future market forecasting based on an examination of previous data.

Brief About the Report

The market's supply-side and demand-side North America Secure Logistics market trends are evaluated in the study. The study provides important details on applications and statistics, which are compiled in the report to provide a market prediction. Additionally, it offers thorough explanations of SWOT and PESTLE analyses depending on changes in the region and industry. It sheds light on risks, obstacles, and uncertainties, as well as present and future possibilities and challenges in the market.

North America secure logistics market size and share is currently valued at USD 15.04 billion in 2023 and is anticipated to generate an estimated revenue of USD 26.15 billion by 2032,according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 6.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032

Key Aspects Covered in The Report

Market size and growth rate during the forecast period.

Key vendors operating in the market with their company profiles

Opportunities and threats faced by the existing vendors in the market.

Trending factors influencing the market in the geographical regions.

In-depth understanding of market drivers, constraints, and major micro markets.

The critical data of each segment is highlighted at an extensive level.

North America Secure Logistics Market Segmentation Analysis

The study offers a thorough analysis of the numerous market segments, including application type, product component, service types, and several geographic locations. The report's segment analysis section contains thoroughly researched expert-verified industry data. Strategic recommendations are given in terms of key business segments based on market estimations.

Future Scope:

The future scope of the North America Secure Logistics Market is strengthened by rising demand for secure transportation, cash management, high-value goods handling, and risk-mitigation solutions across industries. As financial institutions modernize their operations, the need for advanced cash-in-transit services, ATM replenishment, and smart cash vault systems will grow. E-commerce expansion is also driving the secure movement of precious items, electronics, pharmaceuticals, luxury goods, and confidential documents. The integration of IoT, RFID tracking, GPS security systems, and real-time monitoring platforms is enabling greater transparency and operational efficiency. Advanced armored vehicles with enhanced surveillance systems are becoming essential for high-risk routes. The market will also see significant growth in secure logistics for digital assets, data servers, and sensitive IT equipment as cybersecurity and physical security converge. With the rise of legalized cannabis across several states, specialized logistics for cash-heavy businesses and temperature-controlled cannabis products is emerging as a new opportunity. Additionally, stricter compliance regulations in banking, defense, and government sectors will continue driving investment in secure supply chain systems. Automation, robotics, and AI-based route optimization will further streamline operations. Overall, the future market will be shaped by technological innovation, risk prevention, and expanding high-value logistics requirements.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/north-america-secure-logistics-market

Leading Players Analysis

The research report's chapter is entirely devoted to the competition environment. The North America Secure Logistics market key players are examined, analyzing information on their evaluation and development in addition to a quick review of the company. Understanding the techniques employed by businesses and the steps they have recently taken to combat intense rivalry allows one to examine the competitive landscape. It covers each player's company profiles comprising sales, revenue, share, recent developments, SWOT analysis, capacity, production, revenue, gross margin, growth rate, and strategies employed by the major market players.

Different potentials in the domestic and regional markets are revealed by regional analysis of the sector. Each regional industry associated with this market is carefully examined to determine its potential for growth in the present and the future. Moreover, information on recent mergers and acquisitions that have taken place in the market is the subject of the research. This section provides important financial information about mergers and acquisitions that have recently shaped the North America Secure Logistics industry.

Top Players:

Armored Knights (US)

Brinks Incorporated (US)

Dunbar Armored (US)

G4S Secure Solutions (US)

GardaWorld (Canada)

GardaWorld Federal Services (Canada)

LaserShip (US)

Loomis (US)

Securitas AB (US)

TransValue (US)

Wells Fargo Armored Service (US)

Regions Covered in This Report Are

North America (United States, Canada, and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and the rest of South America)

The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

Report Summary

The analysis focuses on the regional forecast by type and application and the North America Secure Logistics market sales and revenue prediction. The research report features data about the target market, such as pricing trends, customer requirements, and competitor analysis. The market growth has been examined using analytical approaches like PESTLE analysis, Porter's Five Forces analysis, feasibility studies, player-specific SWOT analyses, and ROI analyses.

Objectives of the Report

To carefully analyze and forecast the size of the market by value and volume.

To evaluate the market shares of major segments of the market

To explain the development of the industry in different parts of the world.

To analyze and study micro-markets in terms of their contributions to the market, their prospects, and individual growth trends.

To offer precise and valuable details about factors affecting the North America Secure Logistics market forecasts

To provide a meticulous assessment of crucial business strategies used by leading companies.

More Trending Latest Reports By Polaris Market Research:

Liquid Nitrogen Market

Biological Safety Testing Product and Services Market

Multiomics Market

Hospital Electronic Health Records Market

Biological Safety Testing Product and Services Market

DNA Diagnostics Market

Disaster Recovery As A Service Market

CBRN Defense Market

Japan Immunoassay Market

Rising Demand for Secure Valuables Logistics

Polaris Market Research has published a brand-new report titled North America Secure Logistics Market Share, Size, Trends, Industry Analysis Report, By Application (Cash Management, Diamonds, Jewelry, & Precious Metals, Manufacturing, and Others); By Mode of Transport; By End User; By Country; Segment Forecast, 2024- 2032 that includes extensive information and analysis of the industry dynamics. The opportunities and challenges in the report's dynamical trends might be useful for the worldwide North America Secure Logistics Market. The study provides an outline of the market's foundation and organizational structure and forecasts an increase in market share. The study offers a comprehensive analysis of the North America Secure Logistics market size, present revenue, regular deliverables, share, and profit projections. The study report includes a sizable database on future market forecasting based on an examination of previous data.

Brief About the Report

The market's supply-side and demand-side North America Secure Logistics market trends are evaluated in the study. The study provides important details on applications and statistics, which are compiled in the report to provide a market prediction. Additionally, it offers thorough explanations of SWOT and PESTLE analyses depending on changes in the region and industry. It sheds light on risks, obstacles, and uncertainties, as well as present and future possibilities and challenges in the market.

North America secure logistics market size and share is currently valued at USD 15.04 billion in 2023 and is anticipated to generate an estimated revenue of USD 26.15 billion by 2032,according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 6.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032

Key Aspects Covered in The Report

Market size and growth rate during the forecast period.

Key vendors operating in the market with their company profiles

Opportunities and threats faced by the existing vendors in the market.

Trending factors influencing the market in the geographical regions.

In-depth understanding of market drivers, constraints, and major micro markets.

The critical data of each segment is highlighted at an extensive level.

North America Secure Logistics Market Segmentation Analysis

The study offers a thorough analysis of the numerous market segments, including application type, product component, service types, and several geographic locations. The report's segment analysis section contains thoroughly researched expert-verified industry data. Strategic recommendations are given in terms of key business segments based on market estimations.

Future Scope:

The future scope of the North America Secure Logistics Market is strengthened by rising demand for secure transportation, cash management, high-value goods handling, and risk-mitigation solutions across industries. As financial institutions modernize their operations, the need for advanced cash-in-transit services, ATM replenishment, and smart cash vault systems will grow. E-commerce expansion is also driving the secure movement of precious items, electronics, pharmaceuticals, luxury goods, and confidential documents. The integration of IoT, RFID tracking, GPS security systems, and real-time monitoring platforms is enabling greater transparency and operational efficiency. Advanced armored vehicles with enhanced surveillance systems are becoming essential for high-risk routes. The market will also see significant growth in secure logistics for digital assets, data servers, and sensitive IT equipment as cybersecurity and physical security converge. With the rise of legalized cannabis across several states, specialized logistics for cash-heavy businesses and temperature-controlled cannabis products is emerging as a new opportunity. Additionally, stricter compliance regulations in banking, defense, and government sectors will continue driving investment in secure supply chain systems. Automation, robotics, and AI-based route optimization will further streamline operations. Overall, the future market will be shaped by technological innovation, risk prevention, and expanding high-value logistics requirements.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/north-america-secure-logistics-market

Leading Players Analysis

The research report's chapter is entirely devoted to the competition environment. The North America Secure Logistics market key players are examined, analyzing information on their evaluation and development in addition to a quick review of the company. Understanding the techniques employed by businesses and the steps they have recently taken to combat intense rivalry allows one to examine the competitive landscape. It covers each player's company profiles comprising sales, revenue, share, recent developments, SWOT analysis, capacity, production, revenue, gross margin, growth rate, and strategies employed by the major market players.

Different potentials in the domestic and regional markets are revealed by regional analysis of the sector. Each regional industry associated with this market is carefully examined to determine its potential for growth in the present and the future. Moreover, information on recent mergers and acquisitions that have taken place in the market is the subject of the research. This section provides important financial information about mergers and acquisitions that have recently shaped the North America Secure Logistics industry.

Top Players:

Armored Knights (US)

Brinks Incorporated (US)

Dunbar Armored (US)

G4S Secure Solutions (US)

GardaWorld (Canada)

GardaWorld Federal Services (Canada)

LaserShip (US)

Loomis (US)

Securitas AB (US)

TransValue (US)

Wells Fargo Armored Service (US)

Regions Covered in This Report Are

North America (United States, Canada, and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and the rest of South America)

The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

Report Summary

The analysis focuses on the regional forecast by type and application and the North America Secure Logistics market sales and revenue prediction. The research report features data about the target market, such as pricing trends, customer requirements, and competitor analysis. The market growth has been examined using analytical approaches like PESTLE analysis, Porter's Five Forces analysis, feasibility studies, player-specific SWOT analyses, and ROI analyses.

Objectives of the Report

To carefully analyze and forecast the size of the market by value and volume.

To evaluate the market shares of major segments of the market

To explain the development of the industry in different parts of the world.

To analyze and study micro-markets in terms of their contributions to the market, their prospects, and individual growth trends.

To offer precise and valuable details about factors affecting the North America Secure Logistics market forecasts

To provide a meticulous assessment of crucial business strategies used by leading companies.

More Trending Latest Reports By Polaris Market Research:

Liquid Nitrogen Market

Biological Safety Testing Product and Services Market

Multiomics Market

Hospital Electronic Health Records Market

Biological Safety Testing Product and Services Market

DNA Diagnostics Market

Disaster Recovery As A Service Market

CBRN Defense Market

Japan Immunoassay Market

·3كيلو بايت مشاهدة

·0 معاينة