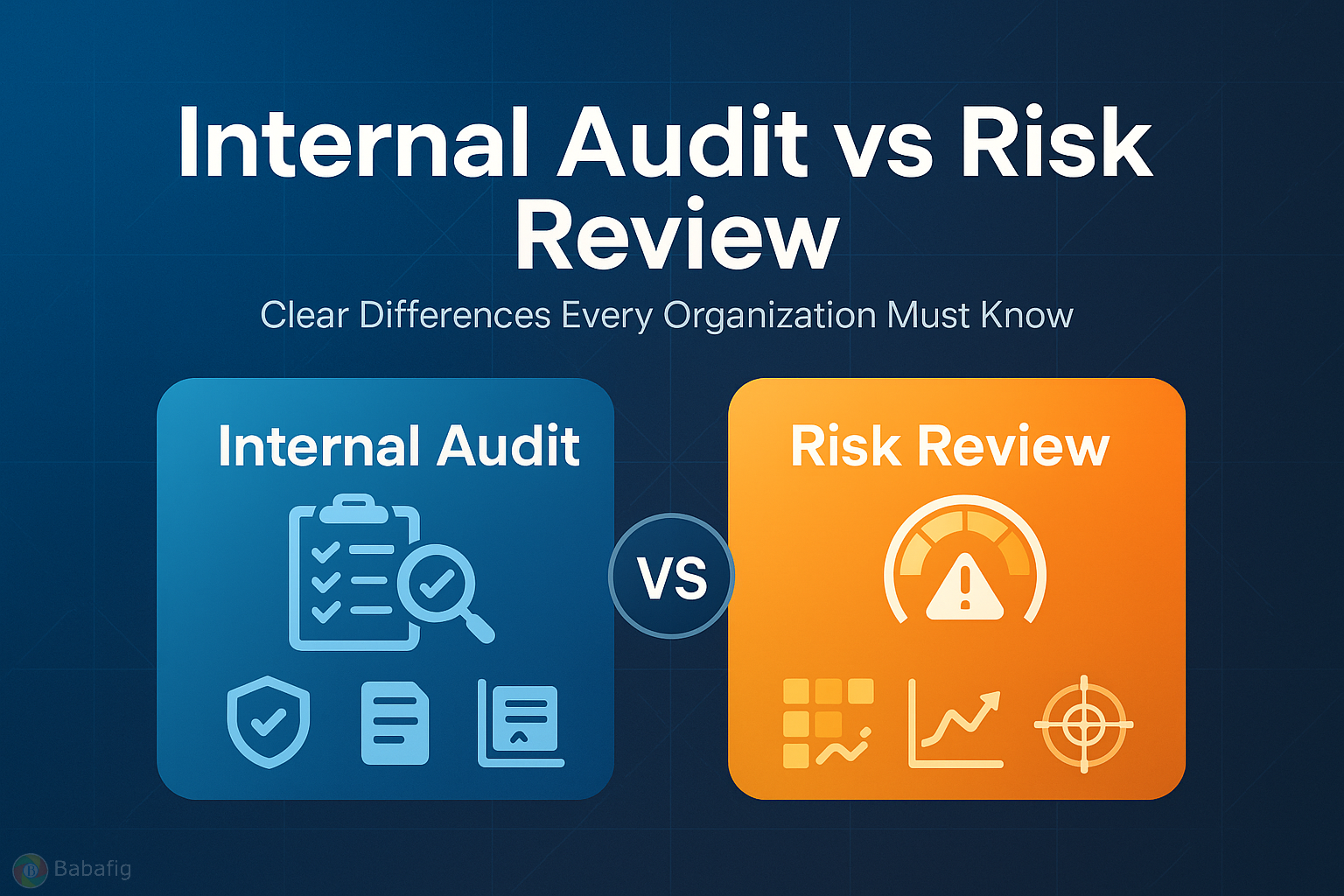

Internal Audit vs Risk Review: Key Differences

In many organizations, the terms internal audit and risk review are mistakenly used interchangeably. While both aim to strengthen governance and support better decision-making, they serve very different roles within the risk management ecosystem. Understanding these differences helps leaders deploy each function more effectively and maintain a robust, proactive, and resilient risk environment.

1. Purpose and Objectives

The primary purpose of an internal audit is to provide independent assurance that an organization’s processes, controls, and systems are functioning effectively. It evaluates whether the operations comply with internal policies, legal requirements, and best practices. The aim is to determine whether controls are adequate and working as intended.

A risk review, on the other hand, focuses on evaluating the organization’s current and emerging risks. It does not assess process compliance; instead, it identifies, analyses, and prioritizes risks that may affect strategic, operational, financial, or reputational goals. The core objective is to understand the likelihood and consequences of risks and ensure that management is addressing them appropriately.

In simpler terms:

Internal audit looks at controls; risk review looks at risks.

2. Scope of Work

Internal audits have a predefined, structured scope based on annual audit plans. These plans are approved by the audit committee and often revolve around specific departments, processes, or compliance areas. Audit findings typically result in corrective action recommendations to close gaps in controls.

Risk reviews have a more flexible and dynamic scope. Since risks constantly evolve, the review process adjusts to internal and external changes. It may include scenario analysis, assessments of control effectiveness, discussions with business units, and evaluation of new threats such as cyber risks, regulatory changes, or market shifts.

3. Approach and Methodology

Internal audits follow a standardized methodology—planning, fieldwork, testing, evaluation, and reporting. Evidence-based testing is central to the audit process, and auditors are trained to assess factual data against established criteria.

Risk reviews use a forward-looking approach. The focus is on anticipating potential disruptions rather than testing existing processes. Tools such as risk matrices, heat maps, risk scoring models, and workshops are commonly used to evaluate the severity and likelihood of risks.

4. Independence and Reporting Lines

Internal auditors operate independently from operational functions and typically report to the audit committee or board. This independent structure ensures transparency and objectivity when identifying weaknesses in controls.

Risk reviews are usually carried out by the risk management team, which collaborates closely with departments across the organization. While they maintain a degree of neutrality, they are not fully independent, as their goal is to support management in managing risks.

5. Output and Value Delivered

Internal audits produce formal audit reports that highlight control deficiencies, non-conformities, and recommendations. Their value lies in strengthening compliance, enhancing accountability, and reducing operational inefficiencies.

Risk reviews result in updated risk registers, action plans, and insight into the organization’s risk exposure. Their primary value is increased preparedness, improved risk awareness, and informed decision-making.

Why ISO 31000 Certification Is Important

ISO 31000 Training Course equips professionals and organizations with a globally recognized risk management framework. It helps individuals gain the skills to identify, assess, and manage risks more effectively, while organizations benefit from structured, repeatable, and proactive risk practices.

Certification is important because it:

Builds strong risk competency across all levels of the business

Enhances decision-making through systematic risk evaluation

Reduces operational surprises by promoting early detection and prevention

Improves governance alignment by integrating risk into strategy and planning

Boosts career growth, credibility, and professional recognition for risk practitioners

In a world of rising uncertainties, ISO 31000 certification ensures that both individuals and organizations are equipped with the knowledge and tools required to navigate risks confidently and consistently.

In many organizations, the terms internal audit and risk review are mistakenly used interchangeably. While both aim to strengthen governance and support better decision-making, they serve very different roles within the risk management ecosystem. Understanding these differences helps leaders deploy each function more effectively and maintain a robust, proactive, and resilient risk environment.

1. Purpose and Objectives

The primary purpose of an internal audit is to provide independent assurance that an organization’s processes, controls, and systems are functioning effectively. It evaluates whether the operations comply with internal policies, legal requirements, and best practices. The aim is to determine whether controls are adequate and working as intended.

A risk review, on the other hand, focuses on evaluating the organization’s current and emerging risks. It does not assess process compliance; instead, it identifies, analyses, and prioritizes risks that may affect strategic, operational, financial, or reputational goals. The core objective is to understand the likelihood and consequences of risks and ensure that management is addressing them appropriately.

In simpler terms:

Internal audit looks at controls; risk review looks at risks.

2. Scope of Work

Internal audits have a predefined, structured scope based on annual audit plans. These plans are approved by the audit committee and often revolve around specific departments, processes, or compliance areas. Audit findings typically result in corrective action recommendations to close gaps in controls.

Risk reviews have a more flexible and dynamic scope. Since risks constantly evolve, the review process adjusts to internal and external changes. It may include scenario analysis, assessments of control effectiveness, discussions with business units, and evaluation of new threats such as cyber risks, regulatory changes, or market shifts.

3. Approach and Methodology

Internal audits follow a standardized methodology—planning, fieldwork, testing, evaluation, and reporting. Evidence-based testing is central to the audit process, and auditors are trained to assess factual data against established criteria.

Risk reviews use a forward-looking approach. The focus is on anticipating potential disruptions rather than testing existing processes. Tools such as risk matrices, heat maps, risk scoring models, and workshops are commonly used to evaluate the severity and likelihood of risks.

4. Independence and Reporting Lines

Internal auditors operate independently from operational functions and typically report to the audit committee or board. This independent structure ensures transparency and objectivity when identifying weaknesses in controls.

Risk reviews are usually carried out by the risk management team, which collaborates closely with departments across the organization. While they maintain a degree of neutrality, they are not fully independent, as their goal is to support management in managing risks.

5. Output and Value Delivered

Internal audits produce formal audit reports that highlight control deficiencies, non-conformities, and recommendations. Their value lies in strengthening compliance, enhancing accountability, and reducing operational inefficiencies.

Risk reviews result in updated risk registers, action plans, and insight into the organization’s risk exposure. Their primary value is increased preparedness, improved risk awareness, and informed decision-making.

Why ISO 31000 Certification Is Important

ISO 31000 Training Course equips professionals and organizations with a globally recognized risk management framework. It helps individuals gain the skills to identify, assess, and manage risks more effectively, while organizations benefit from structured, repeatable, and proactive risk practices.

Certification is important because it:

Builds strong risk competency across all levels of the business

Enhances decision-making through systematic risk evaluation

Reduces operational surprises by promoting early detection and prevention

Improves governance alignment by integrating risk into strategy and planning

Boosts career growth, credibility, and professional recognition for risk practitioners

In a world of rising uncertainties, ISO 31000 certification ensures that both individuals and organizations are equipped with the knowledge and tools required to navigate risks confidently and consistently.

Internal Audit vs Risk Review: Key Differences

In many organizations, the terms internal audit and risk review are mistakenly used interchangeably. While both aim to strengthen governance and support better decision-making, they serve very different roles within the risk management ecosystem. Understanding these differences helps leaders deploy each function more effectively and maintain a robust, proactive, and resilient risk environment.

1. Purpose and Objectives

The primary purpose of an internal audit is to provide independent assurance that an organization’s processes, controls, and systems are functioning effectively. It evaluates whether the operations comply with internal policies, legal requirements, and best practices. The aim is to determine whether controls are adequate and working as intended.

A risk review, on the other hand, focuses on evaluating the organization’s current and emerging risks. It does not assess process compliance; instead, it identifies, analyses, and prioritizes risks that may affect strategic, operational, financial, or reputational goals. The core objective is to understand the likelihood and consequences of risks and ensure that management is addressing them appropriately.

In simpler terms:

Internal audit looks at controls; risk review looks at risks.

2. Scope of Work

Internal audits have a predefined, structured scope based on annual audit plans. These plans are approved by the audit committee and often revolve around specific departments, processes, or compliance areas. Audit findings typically result in corrective action recommendations to close gaps in controls.

Risk reviews have a more flexible and dynamic scope. Since risks constantly evolve, the review process adjusts to internal and external changes. It may include scenario analysis, assessments of control effectiveness, discussions with business units, and evaluation of new threats such as cyber risks, regulatory changes, or market shifts.

3. Approach and Methodology

Internal audits follow a standardized methodology—planning, fieldwork, testing, evaluation, and reporting. Evidence-based testing is central to the audit process, and auditors are trained to assess factual data against established criteria.

Risk reviews use a forward-looking approach. The focus is on anticipating potential disruptions rather than testing existing processes. Tools such as risk matrices, heat maps, risk scoring models, and workshops are commonly used to evaluate the severity and likelihood of risks.

4. Independence and Reporting Lines

Internal auditors operate independently from operational functions and typically report to the audit committee or board. This independent structure ensures transparency and objectivity when identifying weaknesses in controls.

Risk reviews are usually carried out by the risk management team, which collaborates closely with departments across the organization. While they maintain a degree of neutrality, they are not fully independent, as their goal is to support management in managing risks.

5. Output and Value Delivered

Internal audits produce formal audit reports that highlight control deficiencies, non-conformities, and recommendations. Their value lies in strengthening compliance, enhancing accountability, and reducing operational inefficiencies.

Risk reviews result in updated risk registers, action plans, and insight into the organization’s risk exposure. Their primary value is increased preparedness, improved risk awareness, and informed decision-making.

Why ISO 31000 Certification Is Important

ISO 31000 Training Course equips professionals and organizations with a globally recognized risk management framework. It helps individuals gain the skills to identify, assess, and manage risks more effectively, while organizations benefit from structured, repeatable, and proactive risk practices.

Certification is important because it:

Builds strong risk competency across all levels of the business

Enhances decision-making through systematic risk evaluation

Reduces operational surprises by promoting early detection and prevention

Improves governance alignment by integrating risk into strategy and planning

Boosts career growth, credibility, and professional recognition for risk practitioners

In a world of rising uncertainties, ISO 31000 certification ensures that both individuals and organizations are equipped with the knowledge and tools required to navigate risks confidently and consistently.

1 Commentarios

·3K Views

·0 Vista previa